Mileagewise - Reconstructing Mileage Logs for Beginners

Mileagewise - Reconstructing Mileage Logs for Beginners

Blog Article

About Mileagewise - Reconstructing Mileage Logs

Table of ContentsOur Mileagewise - Reconstructing Mileage Logs StatementsThe Basic Principles Of Mileagewise - Reconstructing Mileage Logs A Biased View of Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneNot known Factual Statements About Mileagewise - Reconstructing Mileage Logs Fascination About Mileagewise - Reconstructing Mileage LogsA Biased View of Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Range function recommends the fastest driving course to your workers' location. This feature boosts productivity and adds to cost financial savings, making it an essential asset for organizations with a mobile labor force.Such a technique to reporting and compliance simplifies the usually complicated task of taking care of mileage expenditures. There are lots of benefits related to using Timeero to keep an eye on mileage. Allow's take a look at a few of the app's most noteworthy functions. With a relied on mileage tracking device, like Timeero there is no demand to bother with mistakenly leaving out a day or piece of information on timesheets when tax obligation time comes.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

With these devices in operation, there will be no under-the-radar detours to increase your repayment costs. Timestamps can be discovered on each mileage entry, increasing credibility. These added confirmation procedures will certainly maintain the internal revenue service from having a factor to object your gas mileage documents. With precise gas mileage monitoring modern technology, your employees don't need to make harsh mileage estimates or perhaps fret about mileage cost tracking.

If an employee drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all vehicle expenses (mileage log). You will require to continue tracking gas mileage for job even if you're using the real cost approach. Keeping mileage records is the only method to different business and personal miles and offer the proof to the internal revenue service

The majority of mileage trackers allow you log your trips manually while computing the distance and compensation amounts for you. Many likewise come with real-time trip monitoring - you require to begin the app at the beginning of your trip and quit it when you reach your last destination. These applications log your begin and end addresses, and time stamps, together with the complete distance and repayment quantity.

Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

This includes expenses such as gas, maintenance, insurance, and the vehicle's devaluation. For these expenses to be thought about deductible, the automobile needs to be made use of for organization objectives.

Indicators on Mileagewise - Reconstructing Mileage Logs You Need To Know

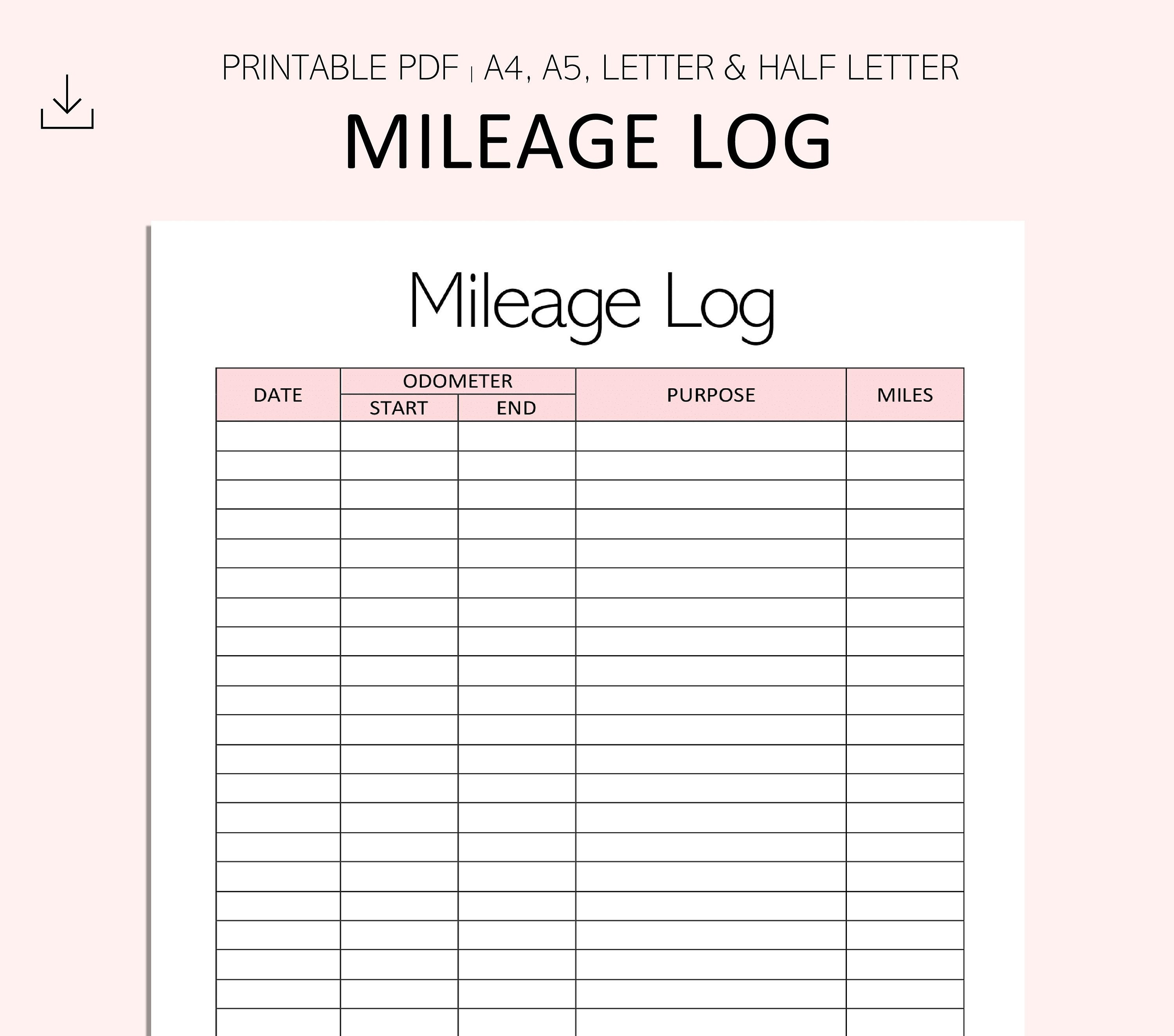

In between, faithfully track all your service trips keeping in mind down the beginning and finishing analyses. For each trip, record the place and service purpose.

This consists of the complete service mileage and overall gas mileage buildup for the year (service + personal), journey's date, location, and purpose. It's necessary to tape-record activities quickly and maintain a synchronic driving log outlining date, miles driven, and company function. Below's exactly how you can boost record-keeping for audit purposes: Start with guaranteeing a precise gas mileage log for all business-related traveling.

What Does Mileagewise - Reconstructing Mileage Logs Do?

The real costs approach is a different to the standard mileage rate method. Rather than calculating your deduction based on a fixed rate per mile, the actual expenditures technique allows you to deduct the real prices connected with utilizing your automobile for organization functions - best free mileage tracker app. These costs include fuel, upkeep, repairs, insurance policy, devaluation, and other related expenditures

Those with substantial vehicle-related costs or special conditions might profit from the actual costs technique. Inevitably, your selected technique ought to straighten with your specific economic goals and tax situation.

A Biased View of Mileagewise - Reconstructing Mileage Logs

(https://www.figma.com/design/5qkgS0W0lb9GSMsCAxlEAB/Untitled?node-id=0-1&t=xTFVnmLUZYrPDnRK-1)Compute your overall company miles by utilizing your begin and end odometer analyses, and your tape-recorded business miles. Properly tracking your specific mileage for organization journeys help in validating your tax obligation deduction, particularly if you choose for the Criterion Gas mileage technique.

Tracking check my source your gas mileage manually can need diligence, but bear in mind, it can conserve you cash on your taxes. Adhere to these steps: List the day of each drive. Tape the total gas mileage driven. Consider noting your odometer readings before and after each trip. Write the starting and finishing factors for your trip.

The 4-Minute Rule for Mileagewise - Reconstructing Mileage Logs

And currently nearly everybody uses General practitioners to get about. That suggests almost everybody can be tracked as they go regarding their organization.

Report this page